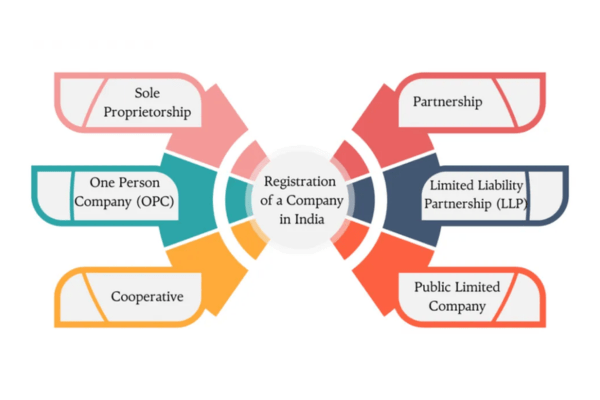

One of the most important factors while starting a new business is choosing the most suitable legal structure. In India, Limited Liability Partnerships (LLP) and Private Limited Company (Pvt Ltd) are the most favoured options. This guide provides a thorough comparison of these two business models and delves into their characteristics, benefits, drawbacks and their appropriateness towards different businesses.

What is Limited Liability Partnership (LLP)?

The Limited Liability Partnership (LLP) is a unique form of business that incorporates characteristics of both partnerships and corporations. For instance, it has the best characteristics of a partnership as well as limited liability of a corporation. In India, The Limited Liability Partnerships are formed and regulated under the Limited Liability Partnership Act, 2008. This form is often used by professionals like lawyers, accountants, and consultants in practice.

An LLP shields the partners from exposure of their personal property in satisfying the business debts and liabilities. In a general partnership, any one partner has to bear the brunt of the other partner’s breach in such circumstances, but in an LLP, it is not the case.

Features of Limited Liability Partnerships

Corporate Body

LLP is a corporate individual. It is distinct of its partners and is thus treated as a corporate affiliation. It is capable of performing legal functions. It can enter into contracts, holds properties, bring and be Brought into Court, and so on.

Separate Legal Entity

The partners of LLP are protected from any risk arising from the partnership since the LLP itself is a recognized legal entity which is independent from its members. Therefore, the partnership can obtain loans, purchase and sell property, and so on in its own name. This guarantees that the business partners do not bear any personal risk for business-related activities.

Perpetual Succession

An LLP does not lose continuity as an entity merely due to the change of partners. If one of the partners goes out, retires or dies, there are no interruptions in the working of the LLP.

Partnership Constitution

The operation of an LLP shall be in accordance with the Limited Liability Partnership Agreement that is made and signed by the partners. The agreement states, inter alia, the functions of each partner, how the partners shall divide profits, etc.

Minimum Partners

An LLP can have as low as 2 designated partners with at least one being an resident of India. There is no maximum restriction over the number of partners in an LLP.

Eligible Partners

Individuals or corporate bodies can be the partners in an LLP. This flexibility makes it suitable for a variety of business collaboration.

What is a Private Limited Company?

A Private Limited Company (Pvt Ltd) is a company structure as per the Companies Act, 2013 in India. This is perhaps most suitable for entrepreneurs and small and medium enterprises. A private limited company shareholders are limited liability which provides personal security.

The structure of private limited companies is quite straightforward for such a type of company has shareholders who own the company while it is directors that carry out the daily activities of the company. These companies have limited liability status, thus can be safely separated from their owners.

Features of Private Limited Company

Limited Liability

The only obligation of the shareholders is to pay for the shares that they own and they have not paid for. In the event the company goes down, assets of shareholders and directors are left unharmed.

Separate Legal Entity

A Private limited company which is similar to an LLP is considered to be an independent institution from its shareholders and directors. It can acquire assets, make agreements and perform business transactions on its own.

Shareholders

Such a company can have between two and two hundred shareholders, and thus it has the possibility of getting more than one shareholder in order to raise funds.

Directors

The limit on directors in a private company is upto fifteen and the minimum is two. The directors oversee day to day management of the business.

Minimum Capital Requirement

Even though the Companies Act, 2013 abolished the minimum capital threshold, it is still necessary to have enough authorized capital for the private limited company to be able to carry out its operations properly.

Ownership and Management

The shareholding is what determines ownership while the board of directors is charged with the management. The strategic distribution of tasks increases the likelihood of role ambiguity.

Transferability of Shares

The shares of a private limited company can be transferred, but the process is limited in order to maintain its so-called private status. However, the transfer is usually subject to the consent of other shareholders.

Compliance Requirements

Some of the compliance norms to which the private entities are obligated to observe include: filing of annual returns, financial accounting statements and board meetings which make them very much regulated than the LLPs.

LLP vs Pvt Ltd Advantages and Disadvantages

The advantages of an LLP are as follows

- Ease of formation: Simple procedure for registration as well as lesser compliance requirements.

- Cost effective: Lower compliance and operational costs in comparison to private limited companies.

- Flexible management: There are no board meetings and no resolutions that have to be passed.

- Tax benefits: There is no tax on the distribution of dividends and profits are also taxed at a flat rate.

The disadvantage of an LLP are as follows:

- Limited options for fundraising: They are not able to solicit equity investment from the general public or from venture capitalists.

- Lack of credibility: They are seen as lacking professionalism when compared to private limited companies.

- Profit-sharing issues: This may lead to misunderstandings amongst the partners.

The advantages of a Pvt Ltd company are as follows:

- Better credibility: They have enhanced reputation amongst investors and financial institutions.

- Easy fundraising: They are able to source for equity and sell shares to investors.

- Limited liability: The assets of the shareholders are secure.

The disadvantage of a Pvt Ltd company are as follows:

- In compliance costs: It entails routine filing of returns, carrying out audits as well as holding friendly board meetings.

- Limitations on the share transferability: It is important to note that the transferability of shares is approval based.

- Elongated processes in formation: Registration and incorporation take more time and more paperwork is involved.

Similarities Between LLP and Pvt Ltd

Separate legal entity

Both LLP and Pvt Ltd are independent of their owners and such entities can operate by themselves.

Benefits on taxes

Now both entities enjoy tax benefits, for example, they can claim the cost of carrying on business as a deductible expense.

Limited Liability

The owners and partners are not personally exposed to the debts and the liabilities incurred by the business.

Registration Process

Both have to be registered with the Ministry of Corporate Affairs (MCA) and are subjected to legislative provisions.

Difference Between Pvt Ltd and LLP

- Liability: Limited to capital contributed by partners.

- Limited to the unpaid amount of the share capital a member undertakes to pay.

- Legal Structure: Partnership agreement is often customized.

- Structurally shareholders are integrated and owners.

- Compliance: Require much less compliance.

- Require a very high degree of compliance.

- Fundraising: Partners can contribute capital only.

- Can issue shares to the general public.

- Perception: Less impressing and feels like a gamble for the investors.

- More credible as well as professional.

Which company type should you register your business with?

To start with, take an assessment of your business and its scale

For smaller businesses that may not require much scale or investment, an LLP can be suitable. For those who wish to invest at an early stage with vast growth potential, a private limited company is advisable.

Fundraising requirements

If you wish to sell shares or require external funding, then a private limited company would determine those boundaries.

Tax rates

Check the tax implications for both structures. It has to be kept in mind that LLPs attract different rates of tax and provisions than private limited companies.

Personal liability protection

Thus, both LLP and private limited companies would restrict personal liability, although the decision would address the level of compliance and flexibility required.

LLP or Pvt Ltd: Which is Better?

When deciding whether to register your business as a Limited Liability Partnership (LLP) or a Private Limited Company (Pvt Ltd), it is essential to weigh their unique features, advantages, and disadvantages. Each structure caters to specific business needs and goals, and the right choice depends on your priorities. Here’s a detailed comparison to guide you.

When to Seek Professionals Help

LLP and Pvt Ltd are forms of business enterprises that can be sometimes difficult to choose. However, it is best that you reach out to Best Business Consultant in India so that you are well versed with the legal, tax and operational nuances of the particular structure that you would like to opt for.

Conclusion

Both the LLP and Pvt Ltd bear certain strengths and weaknesses. LLC’s are cheap and relaxed whereas companies which are private limited have a higher image and are better for expansion. Thus, your expectation should coincide with the business strategy, the needs of the firm being operated and desired expansions. Always look for an expert to help you make the most suitable choice for your business.

Women LLPS brochure explains the difference between private limited company and llp that exist and ways in which these key characteristics of a private limited company and an LLP can help you select the type e that will suit you best in that case.