Selecting the most appropriate type of business structure in India is arguably one of the most important points in the life of an entrepreneur and owner of a business. The specific business structure determines the degree of legal liability, the way the firm gets taxed and prospects for growth and expansion of the firm’s operations. There are a number of business structures in India suited for various needs, giving the entrepreneurs the chance to pick the form that suits them best. This blog will assist you in understanding what types of business in India, what are some of the pros and cons, and what further factors should be considered while selecting the right structure.

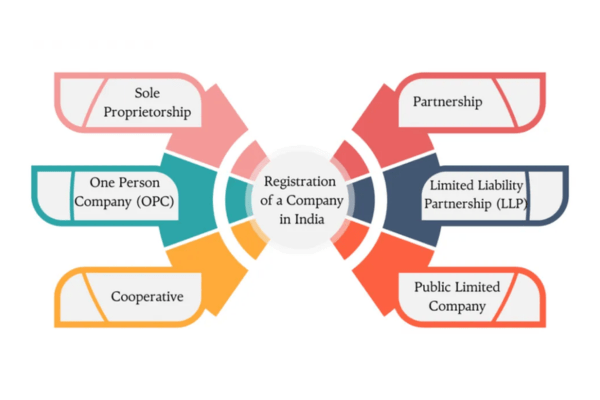

How Many Types of Business in India

Sole Proprietorship

Among different types of businesses, sole proprietorship is the most common which is the simplest form of business structure. It is the one which is owned and operated by one Person.

Pros

- Straightforward set up with little work to ensure compliance.

- Freedom of choice in all decision making.

- Less operational and tax expenditure for small-scale businesses.

Cons

- All business debts can be claimed from the personal assets without limitation.

- Opportunity for expansion and growth is limited as a single financing source is available.

- All facets of management are carried out by the proprietor alone.

Partnership

Partnership is when two or more people own the business, share its responsibilities and profits.

Pros

- General burden on one person is less as responsibility is shared among many.

- Supply of funds and pooling of resources becomes easy.

- Formation is quite easy as there are lot less regulations compared to business corporations.

Cons

- Debts of the partnership have to be paid by the partners and there is no limit to the amount they contribute.

- One partner can create hurdles for the other partner thereby making it difficult to sustain business.

- Absence of a continual succession – a business might be terminated when one partner leaves the business.

One Person Company (OPC)

This is recommended to all the persons who find it difficult to run a business for example A One Person Company – OPC.

Pros

- Personal belongings are safe from liabilities as one person is held accountable.

- Ownership is in one hand which eliminates conflicts creating a smooth business flow.

- Easier to raise funds as a distinct legal entity exists.

Cons

- There is a restriction on the transitioning into other kinds of structures.

- There is greater work to ensure compliance in businesses || compared to the sole proprietorship.

- More than one shareholder cannot be maintained.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) combines the best features of limited liability companies and a partnership.

Pros

- Limited liability shield the portfolios of the partners.

- A partnership leasing easier for them to source investors.

- Management structure is flexible.

Cons

- Partnerships are cheaper to register and cost less to comply with regulations.

- Limited access to third party funding.

Cooperative

A cooperative is also a member owned establishment that aims to meet the needs of all the members.

Pros

- Fosters collaboration of its members and sharing of profits equally.

- Decisions are made through a vote.

- Tax advantages/threats to cooperative societies.

Cons

- Have little capacity for external finance.

- Others might suffer from more inefficiency from shared ownership.

Public Limited Company

A public limited company is also the largest business form it is ideal for those who expect their companies to be funded by the public.

Pros

- The public shares are issued and large sums are raised.

- The business continues regardless of who holds the shares due to perpetual succession.

- Shareholders do not have to be liable.

Cons

- Expect lots of complex legal requirements and follow them.

- Cannot control the business anymore because the public owns shares.

Private Limited Company

A private limited company is one such type of company where most of them are willing to go with in India nowadays especially the new enterprises.

Pros

- They have legal recognition and limited liability.

- Venture capital and private investors have an easier time financing it since there is limited liability.

- If a company engages in uninterrupted business activities, it maintains a distinct identity.

Cons

- The cost to maintain, or even start compliance is very high.

- There are limits to how many and which shares can be transferred.

- It requires at least two members who serve as directors and shareholders.

Joint Venture

A joint venture is an arrangement where two or more individuals, usually businesses, work together to accomplish a common goal.

Pros

- It allows the use of combined knowledge and resources of people involved.

- It allows for the sharing of risks and responsibilities.

- It is the best form of entering new markets.

Cons

- There will potentially be disputes between the partners.

- The completion time is specific as it relates to completion of projects.

Why Selecting the Appropriate Business Form in India is Important

The correct choice of a business structure in India will influence certain key things such as the following:

Legal Responsibility

This chairman does not bear many legal responsibilities.

Taxation

The tax for other forms of businesses greatly varies from individual proprietorship allowing greater profit.

Growth Potential

The possibility of further growth is determined by the structure reached to draw investment and control resources.

Guiding Factors in Choosing the Appropriate Structure

Nature of the Business

The nature of industry and business activities determine the need of the structure.

Investment Needs

In case of structure, ensure it suits your needs whether personal funds or public shares or investors. There are all available.

Government Restrictions and Control

Certain provisions require adherence to strict regulations like those of LLPs or private limited companies.

Liability Consideration

How much risk you are willing to undertake should be weighed in case of unlimited or limited liabilities.

Tax Effects

Examine the tax advantages of LLCs as compared to private limited companies in order to reduce expenses.

Management and Control

Assess the degree of sharing in the decision-making process that you are comfortable with.

Future Growth and Flexibility

Select a legal form with emphasis on long term objectives and development of the business.

Regulatory Compliance

Confirm if the proposed structure can be operated in compliance with the regulatory requirements of the relevant industry.

Why We Need to Consult Professionals

In today’s fast-paced business environment, quick and informed decision-making is crucial, especially when choosing the right business structure. Best Business Consultant in India provides immediate access to expert advice, helping you navigate complex legal, financial, and regulatory challenges efficiently. This approach saves time, reduces costly delays, and ensures you can capitalize on opportunities without compromising compliance or strategic planning. Whether comparing options like LLP vs private limited company or addressing specific business needs, rapid consulting delivers tailored, actionable insights to support swift and effective decision-making, empowering your business to stay competitive and agile.

Conclusion

Selecting an appropriate business structure in India is crucial for operational efficiency and viability over the long term. Businesses should therefore properly consider their strategic vision, liability issues, as well as their desire for growth before they make any commitments. To know more visit Rapid Consulting.

Frequently Asked Questions

What is the most basic business structure in India?

The sole proprietorship is the most basic and the cheapest form of business structure in India and is best suited for single owners with limited resources.

What are the procedures to be followed to incorporate a business structure in India?

- Select the desired name for your business.

- Get a Digital Signature Certificate (DSC) and the Director Identification Number (DIN).

- File applications for incorporation to the Ministry of Corporate Affairs (MCA) or to the relevant authorities in your location.

- Get the required registration and tax certificates such as GST.

What is Joint Venture and how does it function in Indian scenario?

Joint Venture is a formal business arrangement where two or more firms form to benefit from other firms and is used to penetrate new markets, create projects or use a combined workforce.

There is an agreement that states the roles of each party, the responsibilities, and the manner in which profits will be shared.